dependent care fsa limit 2022

The IRS sets dependent care FSA contribution limits for each year. For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of.

This carryover limit is only for the HCFSA or LEXHCFSA and not allowed for the dependent care flexible spending account DCFSA.

. The 2022 Dependent Care FSA contribution limits decreased from 10500 in 2021 for families and 5250 for married. This account can be used for dependent child expenses up to the age of 13. Find out if this type of FSA can help you.

For 2022 the dependent-care FSA limit returns to 5000 for single filers and couples filing jointly and 2500 for married couples filing separately. The HCFSALEXHCFSA carryover limit is. Dependent care FSA carryovers and extended grace periods under the CAA FSA relief do not affect employees subsequent plan year election or income exclusion limits.

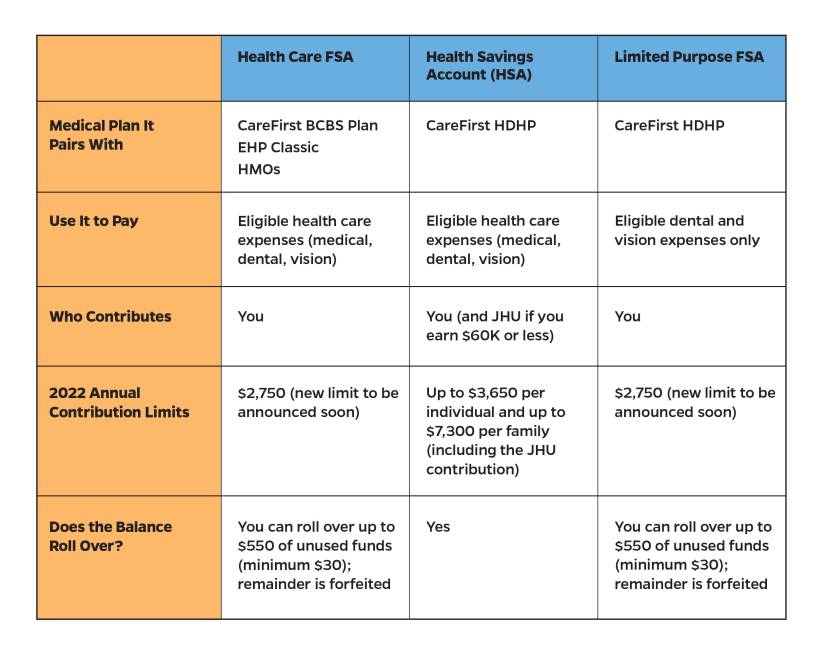

The Internal Revenue Service IRS has announced an increase in the Flexible Spending Account FSA contribution limits for the Health Care Flexible Spending Account HCFSA and the. Contribution limit on a health flexible spending arrangement FSA. If you have a dependent care FSA pay special attention to the limit change.

If you and your spouse. IR-2021-105 May 10 2021 The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022. 10 as the annual contribution limit rises to.

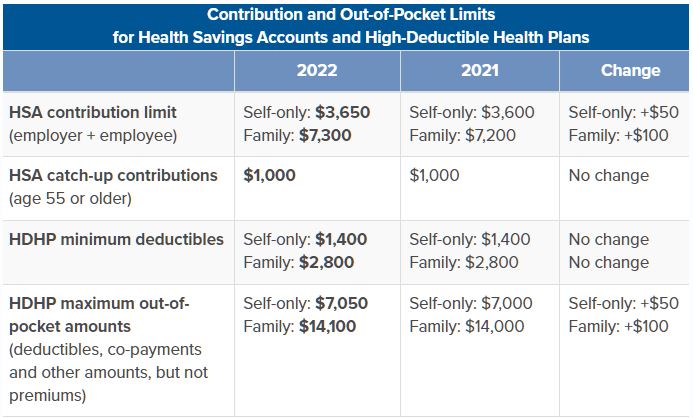

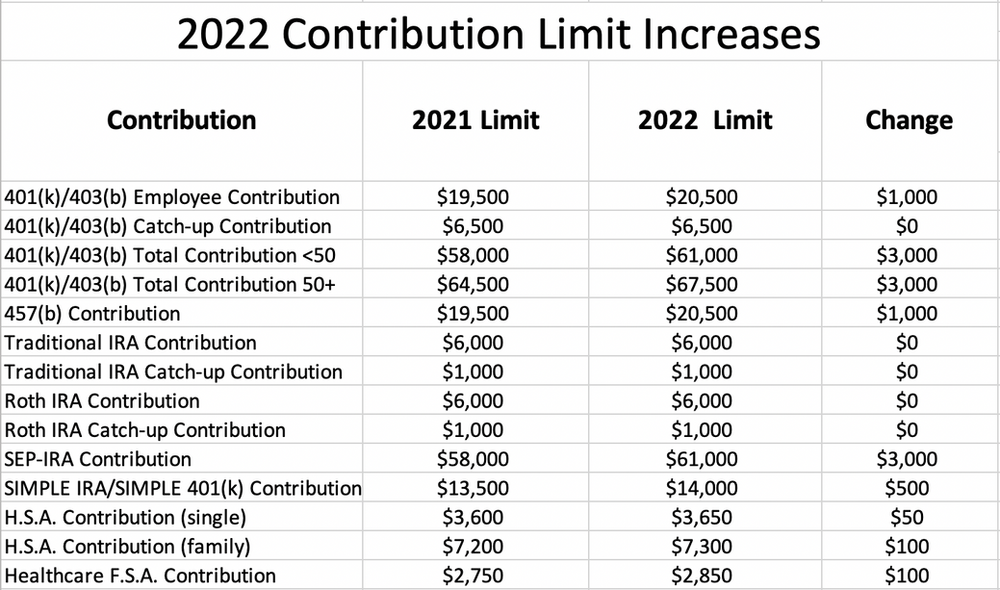

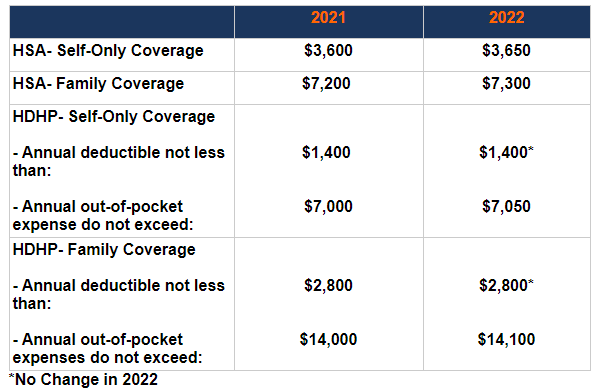

The IRS is planning ahead on HSA plans releasing 2022 HSA maximums and limits on 51121. See below for the 2023 numbers along with comparisons. For 2022 the IRS caps employee contributions to 5000.

However the IRS allows you to keep a certain amount from year to year. See more examples Use our Dependent Care FSA Calculator to see how much you can save with a Dependent Care FSA. A dependent care flexible spending account can help you save money on caregiving expenses but not everyone is eligible.

Your spouse can make a maximum contribution too. Dependent Care FSA Contribution Limits for 2022. For the most part you have to spend the money in your FSA by the end of each year.

What is the family FSA limit for 2022. This is also called a dependent care FSA. The carryover limit is an increase of 20 from the 2021 limit 550.

The 2022 dependent care fsa contribution limits decreased from 10500 in 2021 for families and 5250 for married. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing. You enroll in or renew your enrollment in your.

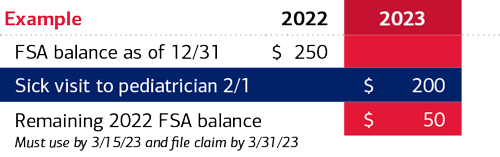

But this law does not go beyond 2022. See below for the 2022 numbers along with comparisons to 2021. In addition Emily used the.

Emily an employee of Oak Co had 4500 deducted from her pay for the dependent care FSA. You can use it for your children under 14 years of age or. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov.

How You Get It.

2022 Hsa Contribution Limits 2 Core Documents

Issues For Dependent Care Flexible Spending Accounts In 2020 And 2021 Web Benefits Design Corporation

What Is A Dependent Care Fsa Wex Inc

What Is A Dependent Care Fsa Wex Inc

Save On Taxes With Jhu Spending Accounts Hub

Using A Dependent Care Fsa To Reimburse Childcare Costs In 2022

Dependent Care Fsa University Of Colorado

2022 Retirement Plan Contribution Limits

2022 Health Fsa Limit Increased To 2 850

Irs Releases Notice 2021 25 And Notice 2021 26 Oca

Fsa Dependent Care Everything You Need To Know

Understanding The Year End Spending Rules For Your Health Account

Fsa Dependent Care Everything You Need To Know

Best Health Accounts Hsas Fsas Hras Optum Financial

Understanding The Year End Spending Rules For Your Health Account